German Spendings in H1 2023: Grocery shopping is quarter more expensive, third less frequent

Consumer behavior of Germans in the first half of 2023 has seen a shift in bank card spending habits

MALTA, September 21, 2023 /EINPresswire.com/ -- German Spendings in H1 2023: Grocery shopping is quarter more expensive, third less frequentConsumer behavior of Germans in the first half of 2023 has seen a shift in bank card spending habits, according to newly released data from the Blackcatcard neobank analysis compared to 2022. The total number of transactions has dipped in key categories, such as supermarkets, restaurants, and gas, but the average amount spent per transaction has increased.

In H1 2023, spending in supermarkets saw a significant decrease in the number of transactions, down by 32.4%. However, the average spend per transaction surged by 23.4% from €26.1 to €32.2 . The overall share of the number of transactions in the supermarket was 18.5%.

At the same time, the restaurant sector saw similar dynamics: there was a decrease in transaction numbers by 6.7%. However, the average spend per visit climbed by 37.65% from €40.9 to €56.3. Fast food establishments’ average spend per transaction was €19.59 in 2022 and €20.5 in 2023 - a 4.6% increase with the number of transactions decreasing by 37.5%.

Department stores experienced a similar decrease in the total number of transactions, down by 30.2%. However, the average amount spent per transaction shot up by an impressive 36.8% from €54.6 to €74.7.

The dynamics of inflation in Germany H1 2022 - H1 2023

It is worth noticing that according to the Federal Statistical Office, from January 2023 to June 2023, inflation fluctuated between 8.7% to 6.1%. That means that slight correlation in bill increase doesn't necessarily indicate a rise in the number of goods in the shopping basket, but might be related to inflation.

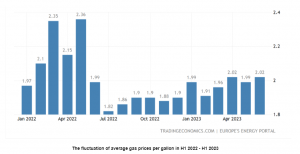

As for the gas station transactions, they dwindled by 10.8%, while the average spend decreased by 6.4% from €88.1 to €82.5. This correlates with economic turbulence seen in H1 2022, when gas price surged, accounting for €2.15 per gallon on average and then decreased to €1.98 in H1 2023.

Additionally, the decrease in the number of transaction might be explained by the habits formed as a response to 2022 petrol price increase, when many germans considered cutting down car usage combined with a general trend, where consumers are attempting to decrease an environmental trace by switching from cars to public transport an constant improvement of public transport infrastructure as a response.

The fluctuation of average gas prices per gallon in H1 2022 - H1 2023

“Whatever factors influenced the decline of the consumer activity since the COVID19 pandemic, behavioral patterns have been changing: economical ability of Germans has not been growing, and consumer activity has been declining”, notes Olegs Chernyshevs, Blackcatcard CTO.

"Facing the challenge of stimulating consumer activity, we need to reassess our approach," says Cernisevs. "Traditional European credit solutions are not particularly evolved and fail to alleviate consumer burden. Therefore, for example, key players of the offline retail market, as well as online marketplaces, stimulate consumers with bonuses and cashbacks through affiliate programs. This approach allows the consumer to save money, maintaining or even increasing their purchasing activity. At the same time, the retail stores or marketplaces and their affiliate partners like banks increase customer loyalty and activity.”

About Blackcatcard

Blackcatcard is an international neobanking solution that launched in 2019 and is based in Europe. It offers virtual and physical cards which can be accepted at any ATM or payment terminal that works with Mastercard. The creation of the account and the virtual card, as well as card maintenance, come free of charge for individuals.

Blackcatcard delivers an online banking service, and an app to manage cards and accounts, as well as all integrated solutions provided by our partners. The service is available for private and corporate clients. In addition to online and mobile banking products, cashback and bonuses* are available in the fintech ecosystem as part of the loyalty program. Individuals can also control all sorts of expenses, including kids and family ones, with additional cards.

The Blackcatcard service is primarily meant for residents of the EEA, but is also well-loved by clients from other regions. The payment card itself is only available to residents of the EEA for now, but residents of almost all countries can seamlessly use the Blackcatcard online banking application including personal European IBAN account, free intrabank money transfers and SEPA payments.

*The bonus payment is a part of the loyalty program provided by FINTECH ASSETS OÜ.

Detailed terms and conditions can be found here.

Natalia Kolesnikova

Blackcatcard

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

Distribution channels: Banking, Finance & Investment Industry, Companies, Consumer Goods, Religion, Shipping, Storage & Logistics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release